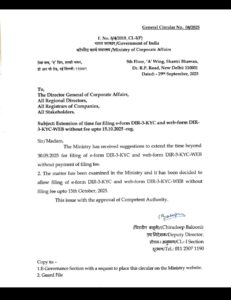

If you’re a company leader looking for a CA in Gurgaon , we have good news. The Ministry of Corporate Affairs’ relief DIR-3 KYC deadline has been moved to October 15th 2025.

Let’s take a moment to think about this big development. The deadline for DIR-3 KYC and DIR-3 KYC-WEB filing is now extended from 30th September 2025 to 15th October 2025, which means that people who missed out on precisely that window owing to a brief token error can still complete this obligation without being charged fine fees. A professional CA in Gurgaon can assist you in completing the procedure accurately and promptly, so that your DIN remains operational and your company remains legal under law.

👉 New Time Period: 15th October 2025

👉 Earlier Period: September 30th 2025

🔎 The Nature of DIR-3 KYC

Every Indian who has a proper DIN (Director Identification Number) must file their DIR-3 KYC once each year. This is to make sure that MCA records are up-to-date with information like your telephone number, email address and place of work.

Compliance with it is in two forms.

- DIR-3 KYC Form – This is needed if you’re filing for the first time or your details have changed.

- DIR-3 KYC-WEB – For directors who have already done their first filing and whose PAN or Passport details are the same as before

For a lot of directors, filing can seem quite difficult – in such cases, turn to a CA company in Gurgaon and the whole job becomes smooth and error-free.

✅ Benefits of Filing DIR-3 KYC through a Gurgaon CA

- Helps your DIN remain active in all MCA work.

- It stops you from being fined ₹5,000 per DIN after the deadline has gone by.

- The person who receives the fees is ‘profe CA, CS, or CMA,’ so you only want this person handling it.

- It helps your MCA compliance proceed without a hitch.

- You can relax since professionals take care of all DSC and portal-related problems for you

So engaging a Gurgaon CA likewise means you will not only have your form filed but also stay ever within the ambit of corporate compliance. For too long, a Gurgaon CA has seemed like he or she does everything on their own. This is not entirely true as it also links back to the brand name and resources of the international accounting firm Ernst & Young. If pursuing the business in Gurgaon, you will no longer be concerned about details like that at Sunil K Khanna & Co because this expert can take care of it all for you from filing forms one all the way through to final on-premise rectification.

📌 Key Highlights of the MCA Extension Last Date Extended : 15th October 2025 Grace Period : In addition to the one given, if you make your return in substantial compliance then 15 days without penalty After Deadline: DINs marked “Deactivated due to non-filing of DIR-3 KYC”; and, ₹5,000 late fee per DIN

📝 Filing Process for DIR-3 KYC Their standard for the first-time filing was:

- First-Time Filing – DIR-3 KYC Form

- Download form from the MCA portal

- Enter details such as Name, PAN, Aadhaar, Email, Phone, Address

- Get certification from a practicing CA/CS/CMA

- Upload with a valid Digital Signature Certificate (DSC)

- Repeat Filing – DIR-3 KYC-WEB

- Log in to the MCA portal

- Verify DIN, Mobile, and Email with OTP

- Submit and save acknowledgment

⚠️ Common Errors Directors Must Avoid

- ❌ Using an invalid or expired DSC

❌ Forgetting to update contact details before filing

❌ Not getting professional certification for the first filing

❌ Filing at the last moment when the MCA portal slows down

By consulting a CA in Gurgaon, you eliminate these errors and file with confidence.

👉 This is not fake news! Why not subscribe to a professional accounting firm like Sunil K Khanna & Co. now for flawless FDI-3- KYC filing.

❓ FAQ (Frequently Asked Questions)

Q1. What is the deadline for DPIN KYC filing 2025?

➡️ October 15th 2025

Q2. What if you do not file?

➡️ MCA will lock your DPIN and levying a fine of 5,000 Yuan.

Q3. Difference between DIR-3 KYC Form and DIR-3 KYC-WEB?

➡️ Form – first time or if details change

➡️ Web – for repeat filing without change

Q4. Who can sign off of DIR-3 KYC?

➡️ A professional chartered accountant, company secretary moving auxiliary or cost accountant for that enterprise